Making money is hard and keeping it is even harder. That is why so many people went broke after making a lot of money. They did not realize that money management is a key component for anyone who wants to be financially successful. In today dynamic’s economy with numerous things to buy online and offline, it can be sometimes difficult to save or track expenses. Other people were able to keep a record of their expenses by writing down manually every day any penny spent. Which is a tedious task but useful to manage any financial assets. However, with the rise of digitalization, budgeting and keeping a check on our daily, monthly, yearly spending has become easier. Various applications exist nowadays to keep a hand over our expenditure. Whether it is for personal finances or a small business, both free and paid ones are available. Here are the 10 best personal finance apps to help you manage your finances efficiently and with ease, based on your needs.

Best Personal Finance Apps For Budgeting

1. Money Lover

Finance management should not be difficult or time-consuming. Money Lover – Expense & Budget Manager is a budgeting application based in Vietnam with millions of users globally. It is optimized for small to big screen sizes, therefore, works perfectly on both Android and iOS. As one of the best free budgeting apps in the market, Money lover provides you tools to track your daily expenses, your income, create a monthly or quarterly budget or so. Moreover, it makes it easier to set up some financial goals, getting the report for payments, Online Invoicing, etc. It’s very convenient and allowed users to reach better results in managing their finances.

2. PocketGuard

Thanks to PocketGuard, another great budgeting app, you will always know what is in your pocket. The application focuses on managing any spendable money by linking users to all their fin-accounts and giving them good visibility of their finances. With graphs and tabs, it provides a simple, interactive, and user-friendly visual experience, as well as a comprehensive picture of spending patterns across all categories. Also, featured in NBC News, Times, and Forbes, Pocketguard is one of the best personal finance apps for budgeting in the market nowadays; When it comes to tracking expenses, savings, and bills all through the month, or the year.

Read Also:

The 5 Best Banks For Business & Personal Banking In Nigeria

When it comes to finances, whether you are an individual or a corporate, banks play a key role in our daily life. And if you... Continue Reading →

3. YNAB – You Need A Budget

Commonly known as YNAB, “You need a budget” is an American budgeting app released in 2004. It is with no doubt among the best personal finance apps of 2021. The YNAB application has been recently listed for 2021 as the “great pick for hard-core budgeters” by Wirecutter. And YNAB’s overall philosophy is to “give every dollar a task.” Regarding the price, the YNAB app has a paid subscription that goes for $11.99 per month or $84 per year. However, there is a free trial for 34 days to allow new users to assess the amazing features of the application.

4. Banktivity

If you are serious about making the most of your money, then you should try Banktivity. It is another awesome budgeting and personal finance management software that helps to reach all your financial goals. Banktivity is a proactive money management software that does everything for you. It offers two budget systems to choose from, envelope and traditional category-based. Envelope budgets (which is the same as YNAB) have the flexibility to move funds around to keep things balanced. Also, it provides more visibility and detail over time compared to many other apps. For example, you can budget your mortgage payments and see your progress over time including weekly, monthly, quarterly, or yearly. While other apps are more focused on the monthly option.

5. Pennyworth Expense Tracker App

Pennyworth Expense Tracker App

Created by Jack Xuan, Pennyworth is a simple but effective financial tool that can help you keep track of your spending. Users can add multiple accounts, and the transactions are available from everywhere. Additionally, it’s accurate, available in multiple currencies, and easy to use with beautiful and advanced reports. Pennyworth is already being used by millions of people across the world to budget and manage their spending, pay off debt, and build wealth. Being among the best personal finance apps for budgeting, Pennyworth Expense Tracker App is also free!

6. Spendee Budget & Money Tracker

Save money with ease! Spendee is a free budgeting tool that has around 3.000.000 users tracking their spending and optimizing their budgets all over the world. Seeing all of your financial habits in one place. The app’s appeal stems from the colorful and visually appealing approach of keeping track of your costs. You may log in easily using Facebook (no cumbersome email registration required) and build your wallet right away. You may set up many categories, enter a budget, and begin tracking your expenditure. Another fantastic feature of Spendee is the ability to invite your family or friends to collaborate on financial or cost planning. It also offers a lovely UI in a modern and colorful style that is available in both free and premium editions, with no advertisements.

7. GoodBudget

The GoodBudget application uses a special budgeting approach. Its virtual tracking feature not only allows you to keep up with friends and family by syncing shares and budgets, but it also allows you to save for significant purchases and pay off debt. The app’s user-friendly interface makes it simple to categorize your typical monthly costs from annual savings objectives and unpredictable spending. It’s worth noting that this software doesn’t integrate transactions with your financial institutions. So you’ll have to keep track of every dollar that comes in or goes out. Another benefit of this software is that it allows you to build personalized reports to track budget trends and provides useful recommendations on how to make a budget and stay ahead of your costs. It works on both Android and iOS phones and tablets.

Read Also:

5 Business Opportunities in Senegal You Should Consider

Senegal is a West African country located on the Atlantic coast. It is a former French colony and is now an independent republic with a... Continue Reading →

8. Monefy

Cost tracking is a time-consuming and complex task using some other tools. The procedure of entering transactions has been simplified with the personal budget software Monefy. Appsquadz Technologies developed Monefy. It’s basic and straightforward; in fact, adding a transaction is as easy as pressing two or three buttons. You can also create new categories or use the app’s predefined categories. There’s also the ability to choose your preferred currency and language. Please note that Monefy Pro, which costs $2.50, has the most fascinating features.

9. Personal Capital

As one of the best financial software, the Personal Capital app focuses on personal finance and wealth management. The tool that lets you manage your assets, investments, and daily spending accounts in one place. You may link your accounts within the app because it integrates with over 14,000 financial institutions. While you can use the app to analyze your spending and build a monthly budget by connecting it to your bank account, it shines when it comes to tracking and optimizing your investments. Which can be tracked by account, asset type, or security. When you compare your portfolio to significant market benchmarks, you can see if you’re on track to reach your investment objectives. Personal Capital has registered financial advisors who can give you personalized advice based on your objectives.

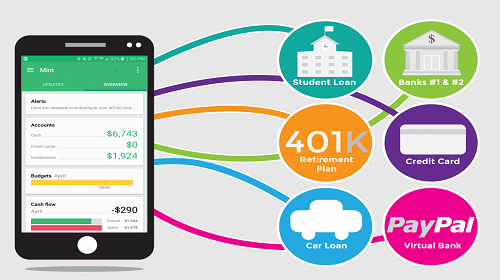

10. Mint

As one of the most widely used full-featured budgeting apps, Mint has a lot of capabilities. Tracking your budget, costs, establishing objectives, paying your bills automatically, and more are just some of the features available. This is a one-stop-shop for all of your budgeting requirements. Mint is a well-known budgeting app that has been around for quite some time. It’s simple to use and can sync with your bank account to collect the information needed to generate a customized budget. It’s easy to use and perfect for keeping track of all your financial and transactional activities. Mint is one of the best personal finance apps for budgeting ideal for ordinary consumers.

Summary

There are numerous approaches to budgeting and saving money. And a budgeting app is one of the most effective tools for managing your finances. It’s much simpler to determine what’s important and then prioritize it. Educational elements are included in applications like the one we discussed above to help consumers understand how to save money. Workshops, video lessons, and other activities fall under this category. Users should keep in mind, however, that financial success requires self-control. Because though the software will not automatically minimize expenses, it will alert users to any expenditures. As a result, assist them in reducing their spending, paying their debts, and growing their wealth at the same time.

Discover more on AFRIKTA:

Atlantic Microfinance For Africa

ATLANTIC MICROFINANCE FOR AFRICA (AMIFA) is a holding company in the form of a limited company with a share capital of 110 million dirhams created... See Full Profile →

Micro-finance Guarantee Agency

The National Assembly Act (Seventh Session of Assembly) established the Micro-finance Guarantee Agency (Tayseer or facilitation). It is a public-benefit Sudanese financial agency that aims... See Full Profile →

H&H Microfinance

H&H Micro Finance (Pvt) Ltd is a fast-growing microfinance institution founded in 2012 and registered with the Reserve Bank of Zimbabwe under the number 000545.... See Full Profile →

Crédit Solidaire Afrique

Crédit Solidaire Afrique (CSA) is a microfinance institution (MFI) created in Senegal by the Chaka Group, on October 14, 2005. In February 2008, the company... See Full Profile →